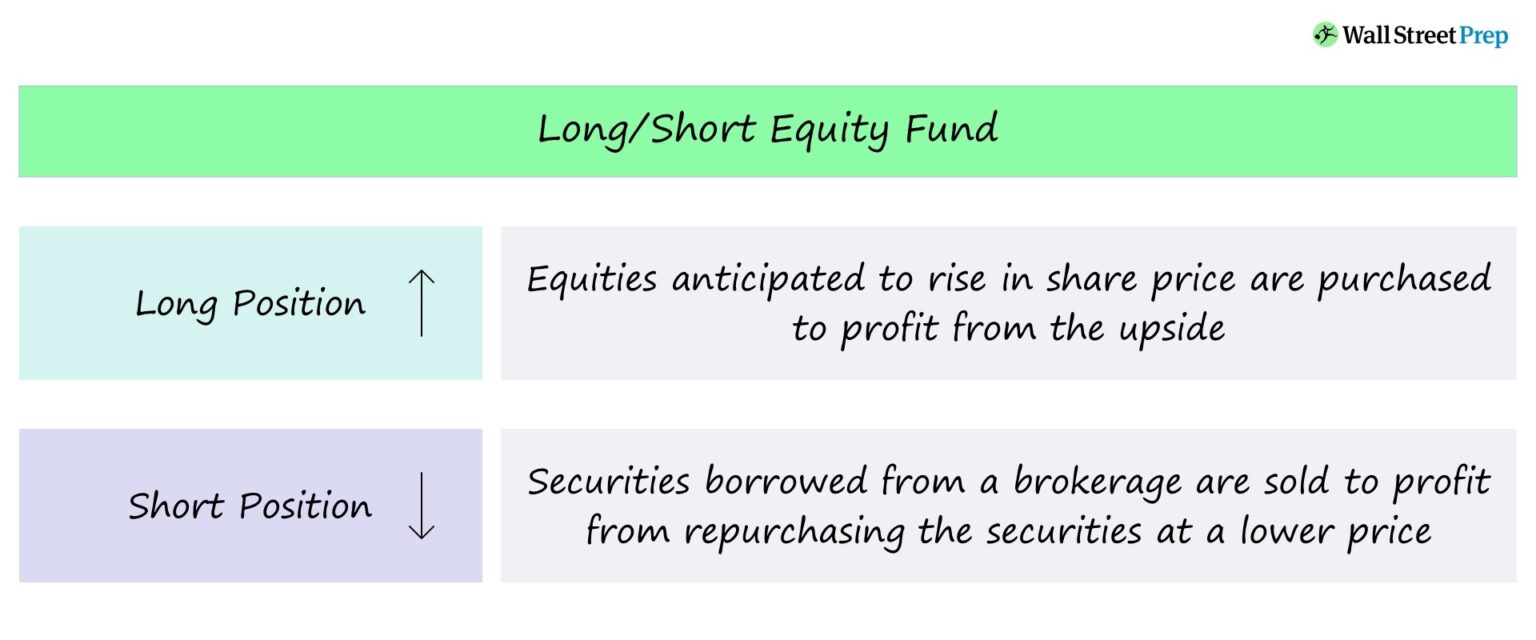

The Acadian Global Equity Long Short Fund had an annual return of 20.75 per cent over three years and 14.9 per cent over five years. Disclosure: The author's SMSF has units in the Aoris.. Global Equity Long Short. This strategy aims to deliver superior long-term returns by actively investing in undervalued companies and short-selling overvalued companies across global developed and emerging markets. The strategy generally maintains a long exposure of 130% and a short exposure of -30%. 40,000+ stocks in developed and emerging.

PPT Global Equity Financing PowerPoint Presentation, free download ID3019208

Investment Outlook Global Equity

Goldman Sachs Global Equity Long Short Portfolio

RUSSELL INVESTMENT COMPANY PLC ACADIAN SUSTAINABLE GLOBAL EQUITY UCITS A EUR ACC FONDS

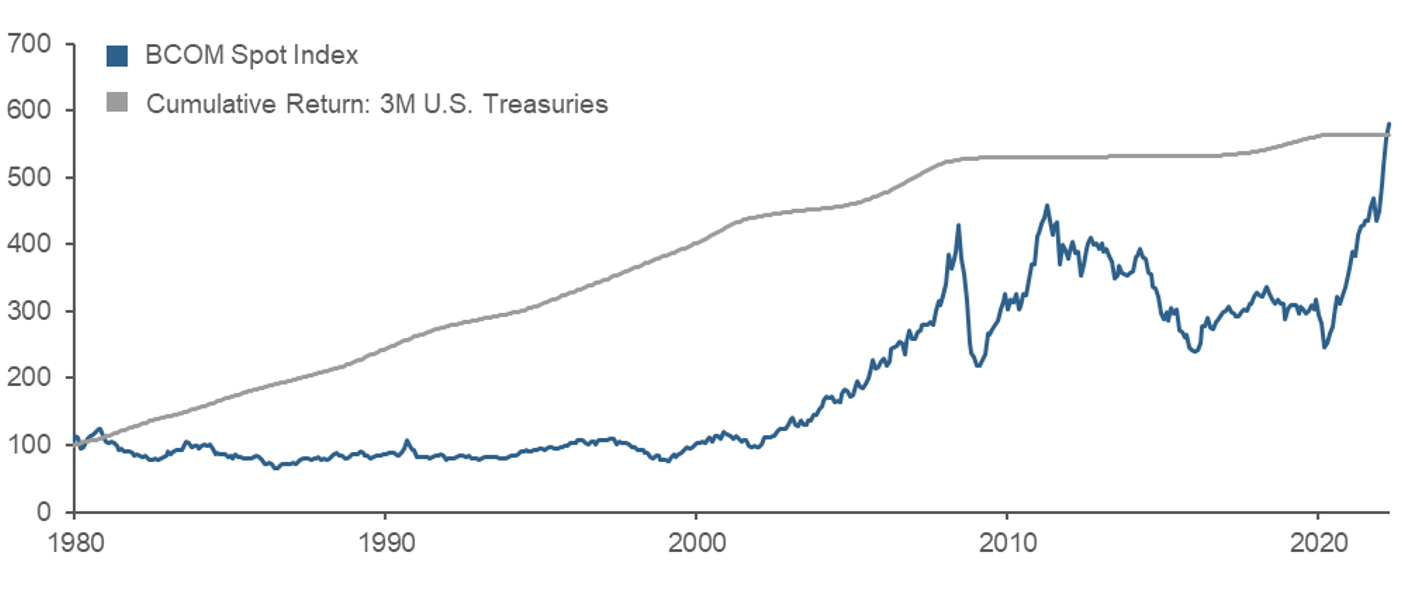

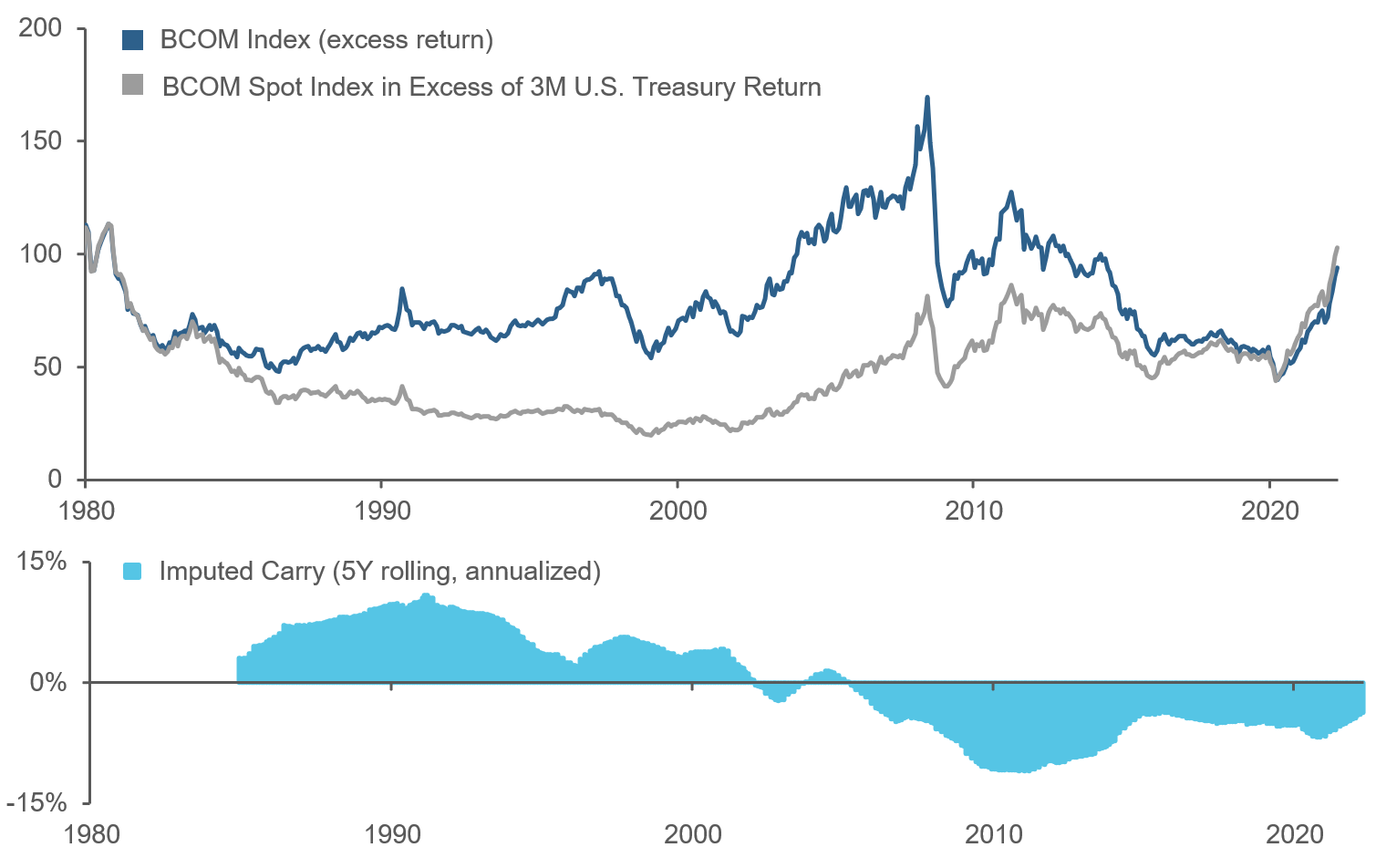

Commodities and Inflation The Long and the Short of It Acadian Asset Management

Long Short Equity Strategy

LongShort Equity (L/S) Fund Strategy Definition + Examples

MAARS Distinguishing Features Acadian Asset Management

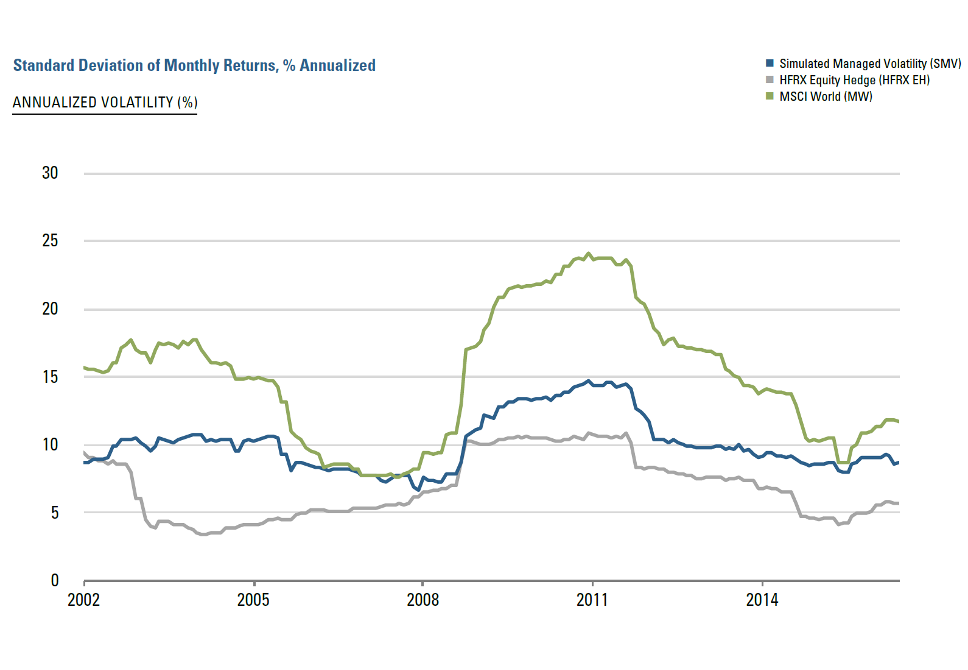

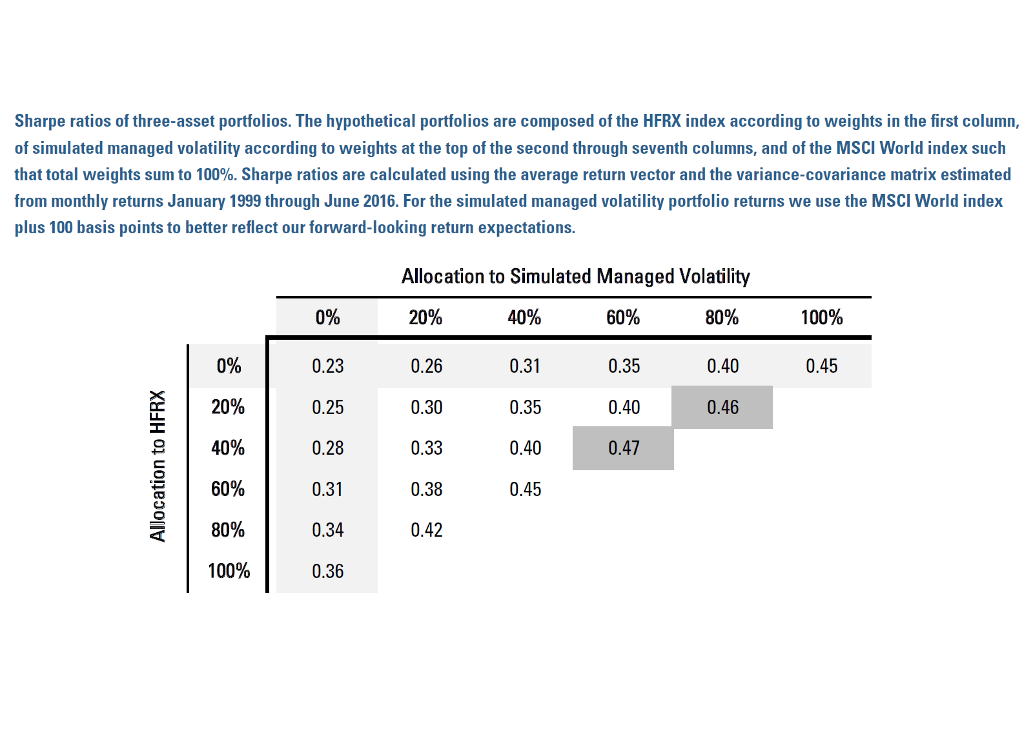

Managed Vol Strategies and LongShort Equity Investment Insights

Managed Vol Strategies and LongShort Equity Investment Insights

Understanding Long/Short Equity Investing Strategies Crystal Capital Partners

NilssonHedge A Managed Futures & Hedge Fund Database Equity Long/Short Index

Australia Asset and Investment Management Acadian Australia

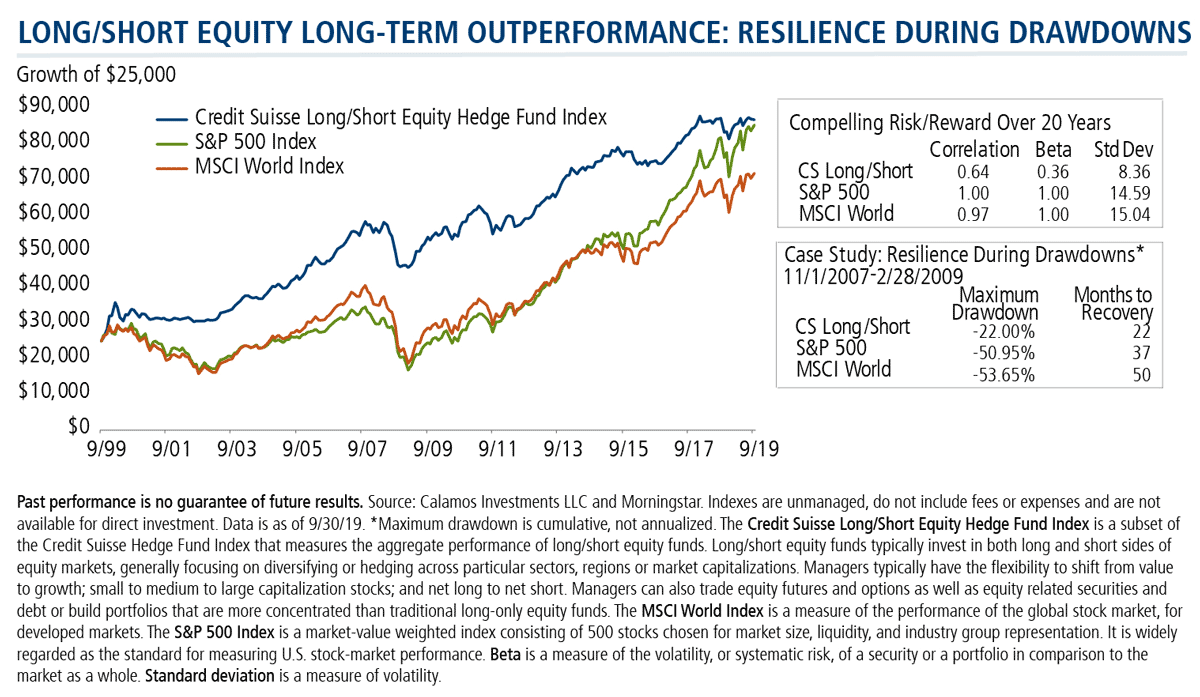

Long/Short Equity Has Outperformed Long Equity Over the Long Term. Period. Calamos Investments

PPT Hedge Fund Investment Strategies PowerPoint Presentation, free download ID2935379

Long Short Equity YouTube

Long Short Equity Strategy

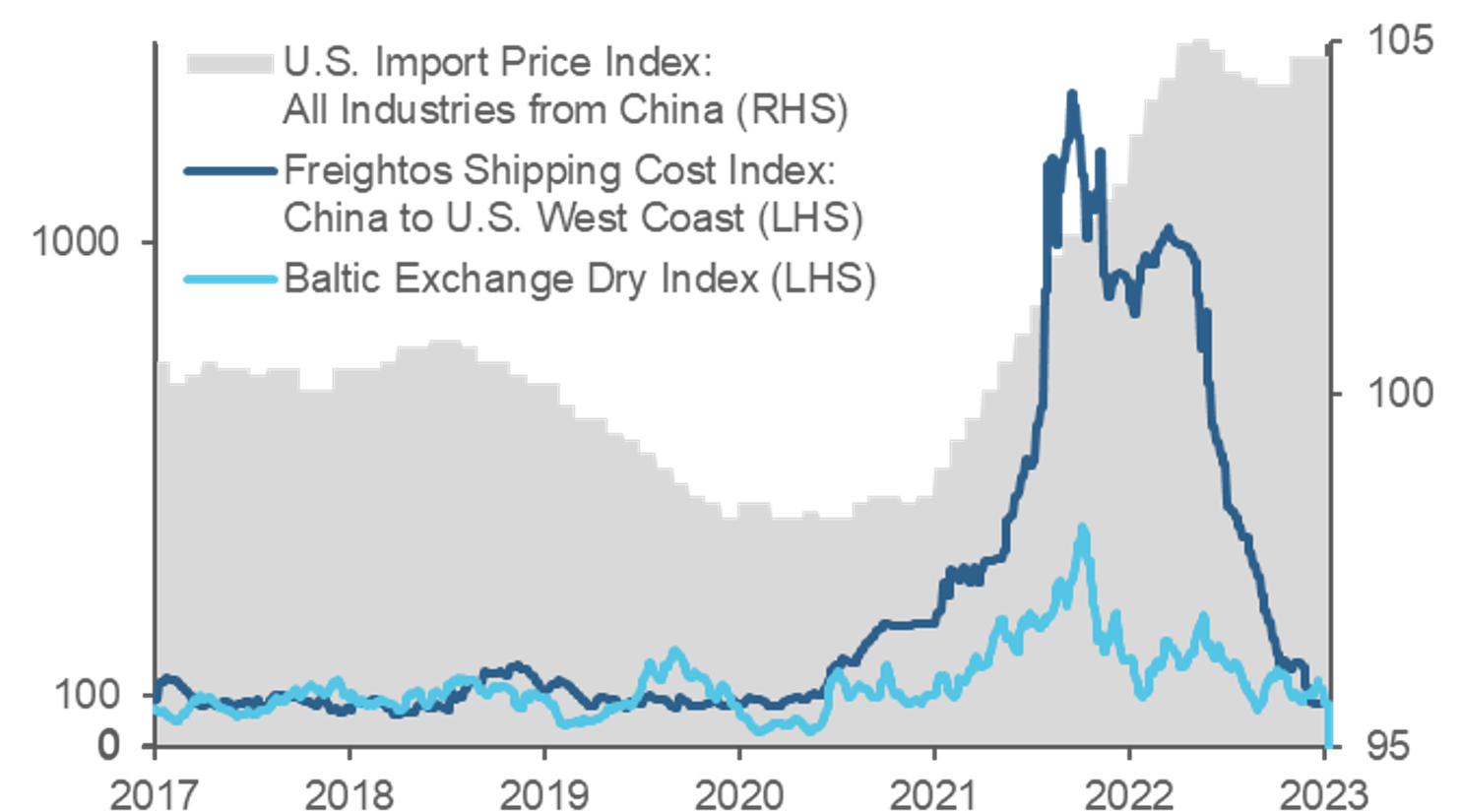

Quick Take China’s Reopening—Actually Inflationary? Acadian Asset Management

GLOBAL EQUITY ABS Global Investments

Commodities and Inflation The Long and the Short of It Acadian Asset Management

Learn more about Acadian Global Equity Long Short-Class A's investment portfolio, including asset allocation, stock style, sector exposure and top holdings.. The Acadian Wholesale Global Equity Long Short Fund seeks to maximise risk-adjusted, long-term returns by investing in undervalued stocks and short selling overvalued stocks from around the world, while carefully controlling portfolio risk and transaction costs. The option aims to outperform the MSCI